As the 2026 tax filing deadline moves closer, new statements from the U.S. government have drawn national attention to tax refunds and recent tax law changes. Many Americans are trying to understand how these updates may affect what they owe and how much money they might receive back this year. With rising costs still putting pressure on household budgets, refund expectations matter more than ever.

Treasury Department Announces Refund Changes

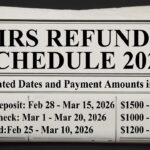

Earlier this week, the U.S. Treasury Department shared a public update highlighting what it described as major benefits from new tax policies. According to the department, tax filing season opened in late February, and refunds for many households are expected to rise under the Working Families Tax Cuts introduced by President Donald Trump. Federal income tax returns are due by April 15.

Officials stated that these changes could lead to higher refunds for millions of Americans. The Treasury estimates that more than 100 million households may receive refunds this year, with the average refund increasing by about $1,000 per household.

Key Tax Changes Affecting Refunds

The administration says several policy updates are driving these increases. These include changes in how tips and overtime income are treated, deductions related to auto loans for American-made vehicles, a higher child tax credit, and a doubled standard deduction. The child tax credit for the 2026 tax year rose to $2,200 and was adjusted for inflation, which the Treasury says affects nearly 90 percent of taxpayers.

Families with two children could see average tax savings of around $1,700 due to these changes. In addition, families with children born between February 1, 2026, and January 31, 2029, may qualify for a $1,000 government contribution into newly introduced child savings accounts.

Experts Urge Caution on “No Tax” Claims

Despite the optimistic messaging, several financial experts have warned taxpayers to be careful. Kevin Thompson of 9i Capital Group told Newsweek that while refunds may rise, some claims are misleading. He emphasized that Social Security income remains taxable under current law and that some reporting systems are still being updated.

Other experts echoed this concern, explaining that many of the “no tax” provisions include limits, thresholds, or income phase-outs. This means the benefits may be smaller than headlines suggest, depending on a taxpayer’s situation.

What This Means for Households

Larger refunds could give families more spending power in the months ahead, potentially easing affordability challenges. However, experts stress that refunds are simply overpaid taxes being returned and do not represent free income. Long-term concerns about government spending and deficits remain part of the broader conversation.

Disclaimer

This article is for informational purposes only. Tax laws and refund amounts depend on individual circumstances and may change due to official updates. Readers should consult the IRS website or a qualified tax professional for personalized guidance.