As the 2026 tax season approaches, millions of Americans are beginning to focus on when their IRS tax refunds may arrive. For many households, a refund is not extra spending money but a financial cushion used to pay rent, cover medical expenses, manage debt, or recover from a difficult year. Understanding the IRS refund schedule for 2026 can help reduce stress and allow better financial planning.

Why IRS Refund Timing Matters in 2026

Tax refunds for 2026 are based on income earned during 2025. With living costs such as groceries, utilities, and insurance still high, refunds remain an important source of short-term relief. When refunds are delayed or smaller than expected, families can face real challenges. Knowing how refund timelines work helps set realistic expectations and avoid unnecessary worry.

When the IRS Will Start Accepting Returns

The Internal Revenue Service is expected to begin accepting 2025 tax returns in late January 2026. Based on past years, January 27 is widely expected to be the opening day. Returns submitted before the official opening will not be processed until the system goes live. Filing early helps place a return in line sooner, but refunds only move forward once a return is officially accepted.

How Long Refunds Usually Take

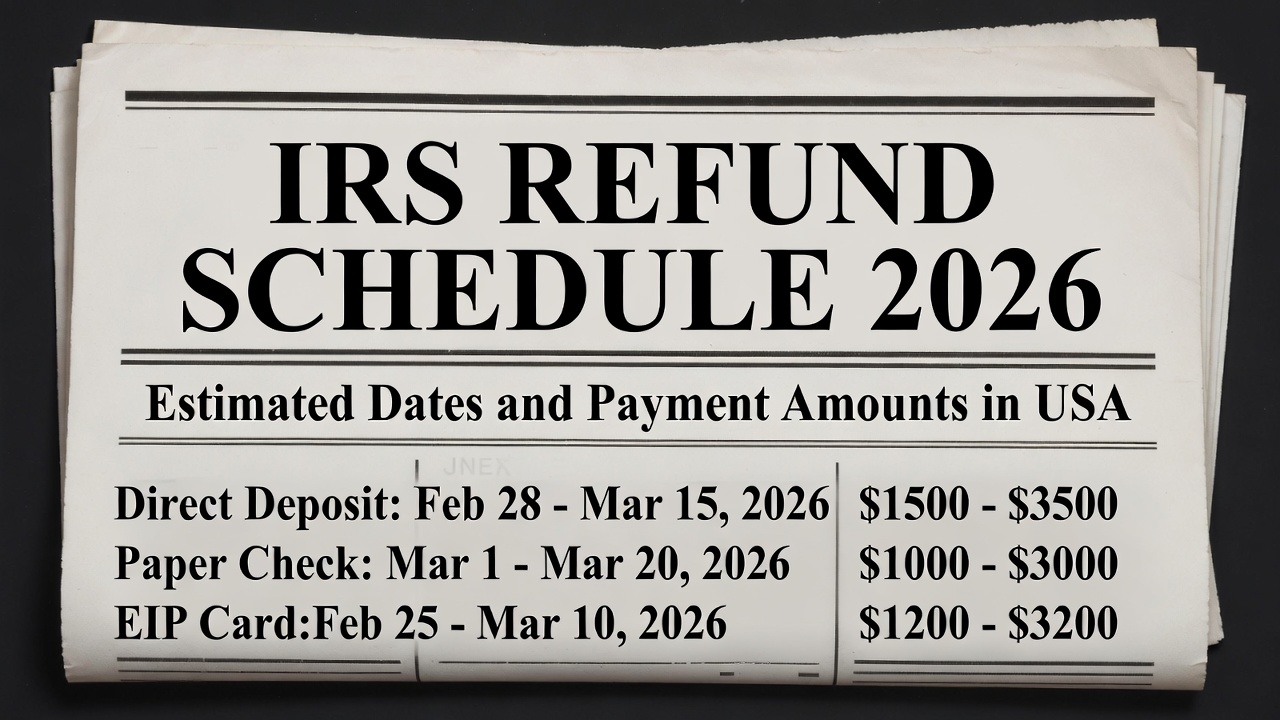

Most taxpayers who file electronically and choose direct deposit receive their refunds within 21 days. In some simple cases, refunds may arrive in as little as 10 to 14 days. However, this depends on the accuracy of the return and whether it requires extra review. Paper-filed returns generally take much longer because they must be handled manually, and mailed checks add additional waiting time.

Refund Delays Required by Law

Some refunds are delayed by law, no matter how early or accurately a return is filed. Returns that include the Earned Income Tax Credit or the Additional Child Tax Credit cannot be released until mid-February. For the 2026 tax season, these refunds are expected to begin arriving around February 18. This rule exists to reduce fraud and applies to all eligible taxpayers.

Why Refund Amounts Differ

Refund amounts vary based on income, tax withholding, family size, and credits claimed. Life changes such as a new job, having a child, or adjusting retirement contributions can affect the final refund. Some taxpayers may see smaller refunds in 2026 due to changes in withholding and the expiration of temporary pandemic-era credits.

Avoiding Common Refund Delays

Errors are one of the most common reasons refunds are delayed. Incorrect Social Security numbers, wrong bank details, missing forms, or income that does not match IRS records can trigger reviews. Carefully checking all information before filing greatly improves the chance of faster processing.

Tracking Your Refund

Taxpayers can monitor their refund using the “Where’s My Refund?” tool or the IRS2Go app. Updates usually appear once per day and show when a return is received, approved, and sent. Once marked as sent, direct deposits typically arrive within a few business days.

Understanding the IRS refund schedule for 2026 allows taxpayers to plan calmly rather than react with frustration. Filing early, filing accurately, and using electronic options remain the best strategies for receiving refunds as smoothly as possible.

Disclaimer: This article is for informational purposes only and does not provide tax, legal, or financial advice. IRS refund schedules, processing times, and rules may change due to legislation or administrative decisions. Refund timing and amounts depend on individual tax situations. Readers should consult the official IRS website or a qualified tax professional for guidance specific to their circumstances.