Federal relief payments often attract strong public interest, especially during times when household expenses remain high. As February 2026 approaches, many Americans are hearing repeated claims about a possible $2,000 federal payment. These discussions have created both hope and confusion. People want to know whether the payment is real, who might receive it, and what steps are required. Understanding the situation clearly helps avoid misinformation and unrealistic expectations.

What Is the Proposed $2,000 Federal Payment

The $2,000 payment being discussed is a proposed one-time federal relief measure. It is not part of regular Social Security, SSI, SSDI, or VA monthly benefits. Instead, it is being talked about as temporary financial support to help individuals and families deal with rising living costs such as food, rent, utilities, and healthcare. The idea is similar to earlier stimulus-style payments, but it would be separate from normal tax refunds.

Has the $2,000 Payment Been Approved

As of now, the $2,000 federal payment has not been officially approved. There has been no confirmed announcement from Congress, the IRS, or the Social Security Administration. Discussions and proposals are still under review, which means no payment date or eligibility list is final. Until formal approval is announced, the payment should be considered a possibility rather than a guaranteed benefit.

Who May Be Eligible If Approved

If the payment is approved, eligibility would likely follow patterns used in earlier federal relief programs. This could include low- and moderate-income individuals, Social Security retirees, SSI and SSDI recipients, veterans, and eligible taxpayers. Final eligibility rules would depend on income limits, residency requirements, and filing status. These details will only be clear once official guidance is released.

How Payments Are Usually Issued

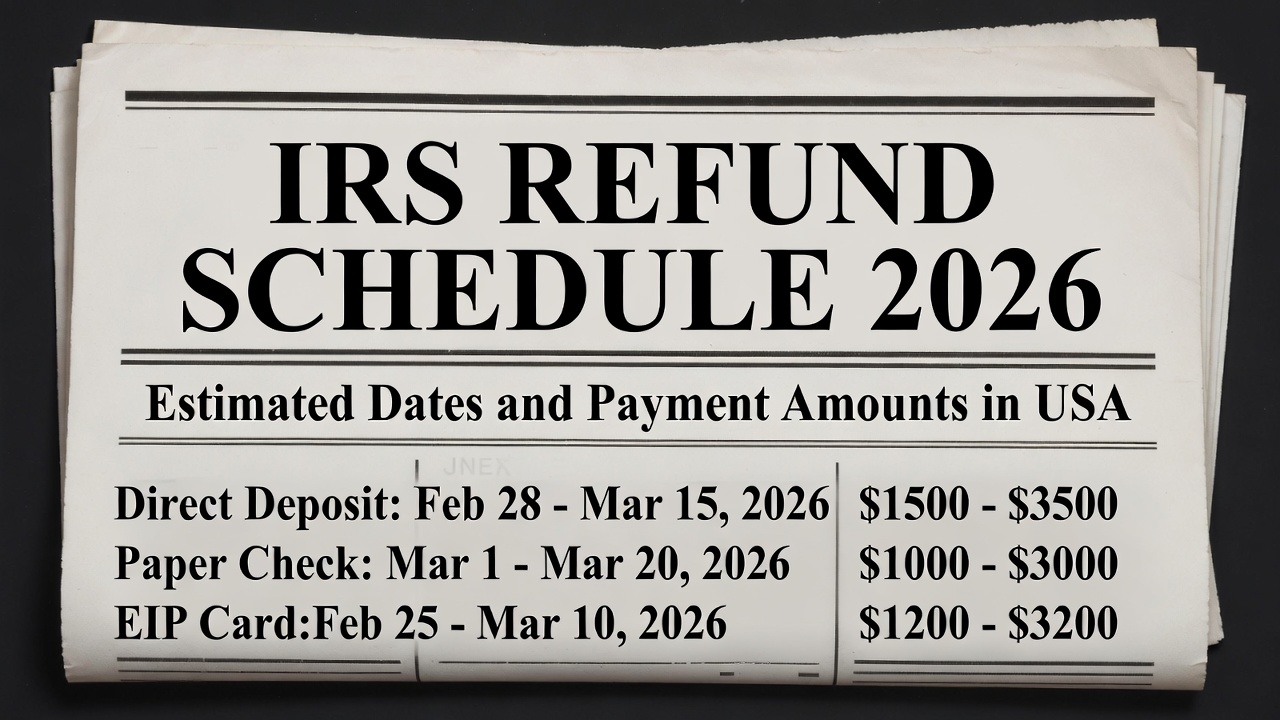

In past federal relief programs, payments were issued automatically using existing IRS and Social Security records. Most people did not need to apply. Direct deposit was used first, followed by mailed checks or prepaid debit cards for those without bank details on file. A similar method would likely be used again to speed up delivery and reduce paperwork.

Why February 2026 Is Being Mentioned

February 2026 is being discussed as a possible timeline because it aligns with federal budget reviews and tax-season systems. However, this date is not confirmed. If approved, payments would likely be sent in phases rather than all at once, depending on how quickly agencies can process information.

Staying Safe From Scams

Whenever talk of government payments spreads, scams increase. Fraudsters may promise guaranteed money or ask for personal information. Government agencies do not request fees or sensitive details through unsolicited calls, emails, or texts. Relying only on official sources helps protect against fraud.

Preparing Without Relying on Rumors

Even without confirmation, people can prepare by keeping tax filings current, setting up direct deposit, and updating personal details with the IRS or Social Security Administration. These steps are helpful for any future payments and reduce delays if relief is approved.

Why the $2,000 Payment Matters

For many households, a $2,000 payment could provide short-term relief for essential expenses. While it would not solve long-term financial challenges, it could offer temporary stability for families and individuals on fixed incomes.

Disclaimer

This article is for informational purposes only and does not provide legal, financial, or tax advice. Federal payment programs, eligibility rules, and timelines may change based on official government decisions. Readers should rely on the IRS, Social Security Administration, or other official sources for accurate and up-to-date information.