Interest in the IRS refund schedule for 2026 is growing as taxpayers across the United States try to estimate when their refunds may arrive and how much they might receive. Every year, tax season brings similar questions, but confusion often increases because of online charts, social media posts, and unofficial claims that suggest fixed refund dates or guaranteed amounts. To avoid disappointment, it is important to understand how the IRS refund system really works and what taxpayers can realistically expect in 2026.

How the IRS Refund Process Works

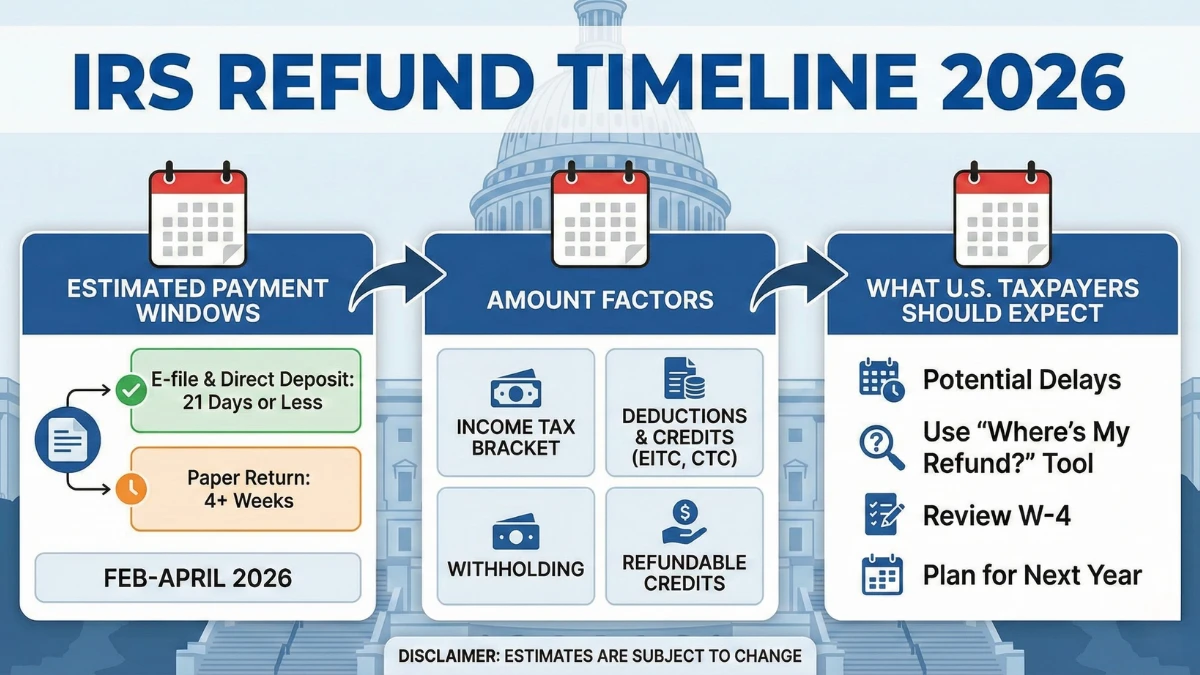

The Internal Revenue Service does not issue refunds on a fixed calendar. Instead, each tax return is processed individually after it is filed. The IRS reviews income details, checks credits and deductions, and matches information with employer and financial records. Only after these steps are completed does the IRS approve and release a refund. Because every return is different, refund timing naturally varies from person to person.

No Guaranteed Refund Dates in 2026

For the 2026 tax season, the IRS will not publish a list of guaranteed refund dates. Any schedules seen online are only estimates based on previous years. While many electronically filed returns with direct deposit are processed within about three weeks, this is not a promise. Some refunds arrive sooner, while others take longer depending on the return’s complexity and accuracy.

What Determines Your Refund Amount

There is no standard refund amount. The size of a refund depends on how much tax was withheld during the year, what credits are claimed, and whether deductions reduce taxable income. Refundable credits such as the Earned Income Tax Credit or Child Tax Credit can significantly increase refunds for eligible taxpayers. On the other hand, owing additional tax or having offsets can reduce or eliminate a refund entirely.

Common Reasons for Refund Delays

Refund delays are usually caused by routine processing checks rather than penalties. Errors in math, missing forms, mismatched income records, or identity verification requests can slow things down. Returns claiming refundable credits often take longer because federal law requires additional review. Filing accurately is more important than filing fast when it comes to refund timing.

Tracking Your Refund Safely

After filing electronically, taxpayers can track their refund using official IRS tools. These tools show when a return is received, approved, and sent for payment. Once the IRS releases the refund, banks control how quickly funds appear in accounts. Checking official sources helps avoid confusion caused by rumors or unofficial websites.

Avoiding Misinformation About Refunds

Claims about surprise payments or new relief programs do not affect refund timing unless the IRS officially announces them. Relying on social media posts or third-party rumors can lead to false expectations. Only information released directly by the IRS reflects real refund activity.

What Taxpayers Should Expect in 2026

The IRS refund schedule for 2026 will follow standard processing rules, not fixed dates. Many taxpayers will receive refunds within a few weeks, but timing and amounts depend on individual filings. Staying informed through official IRS tools and filing accurate returns remains the best approach.

Disclaimer

This article is for informational purposes only and does not constitute tax, legal, or financial advice. IRS refund timing and amounts depend on individual tax returns, processing reviews, and official IRS procedures. For the most accurate and up-to-date information, taxpayers should consult the official IRS website or a qualified tax professional.