As the 2026 tax season begins, millions of Americans are preparing to file their federal tax returns and are closely watching when their refunds might arrive. For many households, a tax refund is not extra spending money. It is often used to cover rent, utilities, medical bills, or lingering holiday debt. To help taxpayers plan ahead, the Internal Revenue Service has confirmed important dates and expectations for the 2026 filing season.

When the 2026 Tax Season Officially Starts

The IRS has confirmed that it will begin accepting and processing federal tax returns for the 2025 tax year on January 26, 2026. This date marks the official opening of the tax filing season. Returns prepared before this date will not be processed electronically until the system opens. The final deadline to file a federal tax return or request an extension is April 15, 2026.

How Long Refunds Usually Take

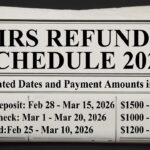

For most taxpayers, the IRS aims to issue refunds within 21 days of accepting a return. This timeline mainly applies to those who file electronically and choose direct deposit. While many refunds are issued faster, the IRS stresses that 21 days is only an estimate. Refund timing can vary based on accuracy, filing method, and whether additional review is required.

Why Filing Method Matters

Electronic filing is the fastest and most reliable way to submit a tax return. E-filing reduces common errors and allows the IRS to process returns more efficiently. When combined with direct deposit, many taxpayers receive refunds within 10 to 14 days. Paper returns take much longer because they require manual processing and may take six to eight weeks or more, especially during peak filing periods.

Credits That Can Delay Refunds

Some refunds are delayed by law. Under the Protecting Americans from Tax Hikes Act, refunds that include the Earned Income Tax Credit or the Additional Child Tax Credit cannot be issued before mid-February. For the 2026 season, these refunds are expected to begin reaching bank accounts during the week of February 23, depending on bank processing times.

Tracking Your Refund Safely

The IRS provides an official tracking tool called “Where’s My Refund?” available on its website and mobile app. The tool updates daily and shows whether a return has been received, approved, or sent. Once a refund is marked as sent, direct deposits usually appear within a few business days.

Avoiding Common Refund Delays

Refund delays often happen due to incorrect Social Security numbers, mismatched names, wrong bank details, or missing income information. Carefully reviewing all details before filing greatly reduces the chance of delays and manual review.

Final Thoughts on the 2026 Refund Schedule

The IRS refund schedule for 2026 offers helpful guidance, but refund timing still depends on individual circumstances. Filing electronically, choosing direct deposit, and submitting accurate information remain the best ways to receive refunds smoothly. Planning with flexibility and using official IRS tools can reduce stress during tax season.

Disclaimer

This article is for informational purposes only and does not provide tax, legal, or financial advice. IRS filing dates, refund timelines, and tax laws may change. Readers should consult official IRS resources or a qualified tax professional for guidance related to their specific situation.